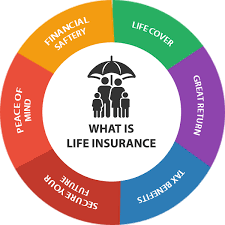

What is Life Insurance ?

Importance of Life Insurance

Life insurance plays a crucial role in financial planning. It ensures that your family or dependents are protected financially in your absence. Life insurance can:

Replace lost income

Pay off debts (like mortgages, loans, or credit cards)

Cover funeral and burial expenses

Fund children's education

Maintain the family’s standard of living

Leave an inheritance or charitable donation

Related Link: https://islamilifeinsurance.blogspot.com/